West Virginians have an unrivaled loyalty for their state that runs as deep as its coal seams. The great state is in trouble, though. For West Virginia and those who love her, it’s time for a wake-up call.

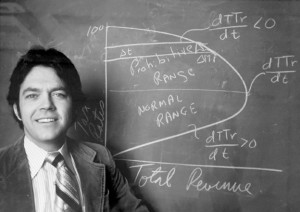

The Laffer Curve, which Laffer sketched on a napkin during lunch with Dick Cheney and Donald Rumsfeld in 1974, is one of supply-side economics’ main theoretical formulas.

By Jennifer Jett Prezkop

Many of us remember getting in trouble as children and being disciplined. Our parents would warn that the punishment was going to hurt but that it was for our own good. Today, West Virginia is in trouble. With changes in the economy and the ebb and flow of various industries as a result of those changes, some states are riding out the storm while West Virginia continues to sink without any visible signs of rescue. It’s time for us to have a serious conversation. It’s a conversation that’s probably going to hurt, but it’s for our own good.

As it stands, West Virginia is at a critical juncture. We must make bold, strategic moves now to lay a solid foundation for the future. We must find a way to not only address the challenges imposed upon the state’s long-valued fossil fuels industry but actively seek out new industry opportunities. We must attract new businesses and retain the highly skilled students graduating from our higher education institutions. It’s imperative that we be forward looking—we have to be proactive, not just reactive. The good news is that, according to Dr. Arthur Laffer, these things are entirely doable—but they must be done, and they must be done now.

An Expert on Economics

Laffer is no stranger to Appalachia and both its economic and industry-related challenges. Born in Youngstown, Ohio, near Wheeling, he has spent a great deal of time throughout his life in the area, and he says he knows West Virginia well.

By trade, Laffer is an academic economist, professor, author and political advisor. He was the first person to hold the position of chief economist at the U.S. Office of Management and Budget, and he was a member of President Ronald Reagan’s Economic Policy Advisory Board for both of Reagan’s presidential terms. He was also a member of the Reagan/Bush Finance Committee’s Executive Committee, and in the 1980s, he advised former British Prime Minister Margaret Thatcher on fiscal policy in the United Kingdom. As of April 2016, he had already been approached by and spent time discussing the economy with just about all of the 2016 presidential candidates. He is widely sought out for his knowledge and experience, and if West Virginia is willing to dig in her heels, he’s willing to help her too.

Laffer is quick to point out that West Virginia has had the poorest performance of any state in the nation in the last 40 years, but he’s just as quick to add that this state, which he affectionately refers to as West By-God Virginia, deserves the best. He is torn between his affection for the state and his frustration at how it is being run.

“West Virginia has such wonderful people,” he says. “How can you sit there and watch this and not feel horrible guilt and take offense by those who are trying to hold West Virginians down?”

Laffer has a lot of ideas about how the Mountain State can pull itself out of this trench it’s dug. His real passion lies in studying the states and analyzing what’s working and what isn’t, and through his research and analysis, he concludes that we must change, and we must change immediately.

The Truth Hurts

Laffer has a lot of good things to say about West Virginia. He adores the mountains and claims West Virginians as his people. He grew up just across the state line, after all, and he connects with the many citizens who are of Scottish/German/Irish descent like himself. When it comes to discussing the state’s current situation, though, he doesn’t mince his words, and what he has to say needs to be heard. It’s not every day a world-renowned economist takes pause in his busy schedule to express concern about a small state like West Virginia. When he does, it’s time to stop and listen.

“West Virginia is the single worst performing state in the nation by far,” says Laffer. “You are the one state that needs to change really badly.”

When Laffer begins talking about West Virginia, his concern for the state’s current position is clear—and urgent. He is appalled by the decisions that have led West Virginia to this point, and he’s frustrated that the state’s leadership is not moving more quickly—or more dramatically—to address our many problems.

“From 1977 to present, West Virginia is the only state that has actually declined in population,” he says, counting off the state’s woes on his fingers. “You have the lowest growth of employment and labor force and the second worst growth in total output of any state in the nation, and you had the fourth lowest gross state product per capita in the country in 2014. You have the single worst rated tort liability system in the U.S. You have the lowest education of adult population ages 25 and older both in terms of bachelor’s degrees and advanced degrees, and you’ve got the fourth highest welfare recipient rate.

“When you look at severance taxes, which are a huge problem in your state, the price of oil and hydrocarbons has collapsed. In addition, you have a war being raged on you by the global warmers that they’re not going to allow you to mine coal anymore in the future, so you have an enormous shortfall of revenue coming from your severance tax. You had one of the worst income tax records of any state, and you have a very high corporate tax. You’ve got all these cities, counties and local districts that all tax income, so you have a huge number of entities separately putting their blood-sucking hypodermics in the bloodstream of your economy.

“You have all sorts of drug problems, which are hand and glove with unemployment, despair and depression. You have to lift the veil of the cloud hanging over the state and let the sun come in. Let things start happening, and that means deregulation, getting rid of your lawyer problem, cutting your tax rates dramatically and prohibiting anyone other than the state from taxing income. And then you use a low-rate, broad-base flat tax so you provide people with the least incentives to evade, avoid or otherwise not report taxable income.

“You need to be focused, focused, focused, every minute of every day on every line item on what creates prosperity and growth, and you’ve got to cut government spending by probably 50 percent. You got rid of your estate tax in 2005, but you’ve still got the inventory tax. You can’t let many people tax the same thing. It’s called the tragedy of the commons. If everyone is allowed to graze their cattle on the field for free, they’re going to overgraze it and kill it. And that’s what you’re doing with all sorts of tax revenue sources in West Virginia.”

His advice? “You’ve got to rethink all these taxes.”

Taxes and Incentives

“Why do we tax people who speed? To get them to stop speeding. Why do we tax cigarettes? To get people to stop smoking. Why do you tax people who work and produce and earn income?” These were questions Laffer posed to the attendees of the West Virginia Chamber of Commerce 2015 Annual Meeting and Business Summit in October 2015. The last question was met with silence as the realization of the power of taxes hit home.

Laffer is known for his work with tax structures and their impacts on the economy. Often referred to as the father of supply-side economics, he played an influential role in triggering a worldwide tax-cutting movement in the 1980s. The Laffer Curve, the illustration of the tradeoff between tax rates and actual tax revenues, which he sketched on a napkin during lunch with Dick Cheney and Donald Rumsfeld in 1974, is one of supply-side economics’ main theoretical formulas. He has also authored and co-authored several books, including “Return to Prosperity: How America Can Regain Its Economic Superpower Status,” “Rich States, Poor States: ALEC-Laffer State Economic Competitiveness Index” and “The End of Prosperity: How Higher Taxes Will Doom the Economy—If We Let It Happen.” What he has observed of late is that there is a revolution occurring based on economics and incentives, and taxes play a key role on the incentives side.

“People don’t work to pay taxes,” says Laffer. “People work to get what they can after taxes. It’s a very personal and private incentive that motivates people to work. Businesses don’t locate their plant facilities as a matter of social conscience. They locate their plant facilities to make an after-tax rate of return for their shareholders. People don’t save to go bankrupt. They save to augment their wealth, not reduce their wealth. If you tax people who work and pay people who don’t work, don’t be surprised if you find a lot of people not working.”

He also believes that if the government taxes rich people and gives the money to poor people—otherwise known as wealth redistribution—there will be a lot of poor people and no more rich people. “Whenever you take money from someone who has a little more, you reduce their incentive to work, and they produce just a little bit less,” he explains. “By giving that money to someone with just a little bit less, you provide that person with an alternate source of income other than working, and that person will work a little bit less. When you redistribute income, you always reduce total income. That’s not a choice or a taste or politics. That’s math.”

Laffer is an advocate for the low-rate, broad-base flat tax and strongly opposes the progressive income tax. In the book he finished about a year ago, titled “The Wealth of States,” he wrote about a study he conducted comparing the 11 states that introduced income tax in the last 55 years, including West Virginia, Pennsylvania and Ohio. Laffer looked at the economic metrics of each state—population, total output and total tax revenues relative to the rest of the nation—in the five years before the progressive income tax was instated as well as the most recent data for each state. According to his findings, the ratings of each state with a progressive income tax relative to the rest of the nation declined.

While politicians were most likely looking for money to fund schools, highways, police departments and public services when they introduced the income tax, when Laffer looked at the provision of public services in the 11 income tax states, he found that eight of the 11 actually declined in public services compared to the rest of the states that didn’t introduce an income tax. None of the expectations for increased funding for services from the tax became a reality.

With a low-rate, broad-base flat tax, Laffer says revenue for public services would be generated while posing the least harm to employment, output and production. “On a static basis, a 3.6 percent flat tax on total income—both personal income and business net sales—would generate approximately as much revenue as West Virginia’s combined state and local property taxes, general sales taxes and income taxes,” he says. “The dynamic effects of a flat tax with reduced uncertainty better incentivizes and lowers costs of administration for government and compliance for business and would give an enormous boost to West Virginia’s economy.”

The 2016 Legislative Session

Unfortunately, according to the opinion of many West Virginians, one of the things the 2016 legislative session failed to do was provide that much-needed boost to the state’s economy. While criticism for the 60-day regular session still runs high, Laffer identified some pros among the cons, the most important of which were the passage of the right-to-work bill and the repeal of prevailing wage.

“I like that the Legislature passed right-to-work over the governor’s veto and got rid of the prevailing wage,” he says. “Right-to-work is one of the single biggest positive changes a state can make to put itself on a pro-growth path. Repealing the prevailing wage was also a big step in the right direction. Markets are far better than governments at determining appropriate wages.”

He was also happy to see the Legislature reject a bill that would have raised sales and gas taxes as well as DMV fees in order to fund the state’s much-needed infrastructure improvements. He was, however, in opposition of the elimination of the severance tax and says getting rid of it is a problem the magnitude of which many people don’t yet realize.

“You’ve got a huge slam coming with the drop in the severance tax revenues,” he says. “They are about 8.5 or 9 percent, I think, of your total tax revenues. Believe me when I tell you these revenues are going, and when they go, it’s not going to make your state richer. In West Virginia, you were sufficiently powerful to tax the heck out of coal, so you had a high severance tax, and now when coal goes, you’ll get slammed by dropping it.”

Recommendations for Action

“You’re destroying every person’s future right now in West Virginia,” Laffer says of state leadership and poor decision making like the reduction of the severance tax. “West Virginians are the most wonderful people on earth. The government is holding them down with its regulations, its tort system, the tax system and the free education that is not free and is not education in West Virginia any longer. I wish I could just get in there and do it for you. I could create prosperity in West Virginia. I can guarantee you that.”

Laffer says he would be happy to work with state government to create a plan for economic growth that would start making the state prosperous in one year and really prosperous in 15 years. Until he gets that invitation, though, he’s provided some key recommendations that, if followed, will help begin the long process of turning the state around.

- Become a Zero Income Tax State. “Guess what’s happening to rich people in West Virginia,” he says. “They are leaving. They are going to the zero income tax states like Florida, Texas and Tennessee. In the top seven fastest growing states in the nation, there are zero income taxes. You’ve got to push yourselves into that rank.”

- Switch to a Low-Rate, Broad-Base Flat Tax. “You can’t love jobs and hate job creators,” says Laffer. “I would dare say that if I did any of the work in West Virginia that I’ve done in other states like Kentucky and Tennessee, I bet I would find an enormous number of cases of the state’s department of revenue going after companies for things like property tax, wasting huge amounts of time on confusing, arbitrary, complicated tax codes that no one understands. Get rid of all that and have one low-rate, broad-base flat tax for the state and maybe a property tax—that’s one property tax, not 57.”

- Eliminate the Inventory Tax. “Today, West Virginia and Kentucky are the only two states that still have this tax,” Laffer points out. “This is a huge job killer because companies can literally go to just about any other state and avoid this tax.”

- Implement Tort Reform. “If you look at West Virginia, it has the lowest liability system, ranked lowest in the nation by ‘Rich States, Poor States,’” says Laffer. “Tort reform is really important because output and production will change in your favor if businesses think they can get fair treatment in your state.”

- Eliminate Tax Incentives for New Businesses. “Why should you give an outside company moving into West Virginia a tax break when a company that decides to stay in West Virginia does not get a tax break?” Laffer asks. “Get rid of all the funds that can be used by the governor and his or her administration to attract business with tax breaks.”

- Eliminate Free Services. “Stop giving services away for free because they aren’t free,” he says. “They are actually really expensive.” Laffer compares the availability of free health care, for instance, to a smorgasbord. “The worst thing in the world for me is a smorgasbord where you pay a lump sum and eat all you want. I overeat, and I overconsume the most expensive things. Right now, you have a system where you don’t even pay the lump sum. Education, health—everything should be paid for marginally by people. For the very poorest of our society, yes, you should have homeless shelters and soup kitchens and free health clinics, but that’s it. Every dollar you spend is a tax on someone’s work, and they aren’t choosing to come to West Virginia to work.”

- Consider Implementing School Vouchers and Charter Schools. According to Laffer, both of these are options that would work well, but he is particularly fond of the voucher idea. “West Virginia public schools aren’t great public schools,” he says. “You’re wasting your money and educating other people’s labor force by destroying your own economy. What you need is a voucher system funded by the education budget. You have people who may want to come to West Virginia for a job, but if they have kids, their kids need to be educated. They aren’t wealthy enough to send their kids to private schools, and they can’t put them in the public schools—that’s a tragedy waiting to happen. You need to give them a supplement, the amount of money you would have spent on them in the public school, and let them use it the best way they see fit. Then you might start getting these high-skilled people coming to West Virginia.”

- Provide Incentives for Students. “Reward students for doing well in school,” Laffer suggests. “Give the students in the top percentile of their class a scholarship or cash bonus for their achievement. You want to create a hyperactive system that really creates excellence in prosperity, and this will help achieve that goal.”

- Switch to a Merit Pay System for Politicians. “Politicians spend other people’s money, and it’s much easier to do that when you don’t bear the consequences of the bad money decisions you make because it isn’t your money,” says Laffer. He believes politicians should bear the consequences of their actions, and he recommends the use of a merit pay system. For instance, if West Virginia’s growth is X, politicians get paid their salary. If the rate is X plus 5 percent, their pay is doubled. If it’s less than X, they don’t get paid. If it’s less than zero, they have to pay the state. “Politicians would never vote the way they do if they had to bear the consequences of their own actions,” he says.

Even if none of these suggested actions are implemented right away, Laffer implores the state to move forward with this in mind: economic growth is the key.

“West Virginia needs economic growth to bring the poor, minorities and disenfranchised back into the main stream of growth, output, employment and production, and West Virginia needs this more than any other state,” says Laffer. “Economic growth is how it has to happen, and when you look at legislation, if it’s not pro-growth, get rid of it. Look at those little babies—what is their future? There is no future in the way you’ve been doing it. Please, please, please give free markets a chance. They’ll solve your problems.”

8 Comments

Read about what happened in Kansas when they followed Laffer’s advice

http://www.theatlantic.com/politics/archive/2015/06/where-republicans-went-wrong-in-kansas/396398/

Anthony –

We appreciate you taking the time to read our content and comment. We presented your comment to Dr. Laffer’s team, and they suggested the following article (you’ll need a trial with IBD for the full text):

http://www.investors.com/politics/brain-trust/laffer-and-moore-sweet-supply-side-revenge-for-tax-cutters-in-kansas/.

Another one of our readers also shared this article from the Wall Street Journal that cites Kansas’ 4.2% drop in unemployment and the increase in wages and job growth under Laffer’s recommended tax cut structure:

http://www.wsj.com/articles/seeded-with-tax-cuts-kansas-harvests-the-benefits-1431729743.

Just some food for thought!

Mr. Laffer is correct. Most of the population centers of WV are located near a border with another state. Many travel to those states for work and/or personal purposes. I live near the MD/VA borders. Many of my neighbors cross the border for fuel, food, entertainment, booze, etc. Why? Taxes and therefore prices are less. Just spending that money within the state, multiplied by all the residents that do it, would be huge boost to the state’s economy. The top income tax rates are way too high, and the brackets too small. I pay a higher marginal rate than I used to pay in NJ. That’s ridiculous. Ok, Maybe you don’t go to zero tax overnight, but if you implement it over a 3 to 5 year plan, you will encourage employers to relocate and people to relocate. I see it first hand. It would work.

One of West Virginia’s biggest issue is our internet and communications network, who in their right mind wants to move to a state that has the slowest, worst internet in the country?

Read about what actually happened in Kansas after they followed Laffer’s advice, ie, nor from the poinnt-of-view of a left-wing, big government statist. http://www.wsj.com/articles/seeded-with-tax-cuts-kansas-harvests-the-benefits-1431729743

I respect Mr. Laffer’s article, ideas, and his credentials but was a bit disappointed in his research. One of his recommendations is for WV to implement tort reform and lessen regulations. As a member of the WV House Judiciary Committee this was our focus for the 2015 legislative session and much was accomplished. He gives no recognition to this fact. He also mentions providing incentives for students and rewarding them for doing well in school. Our PROMISE scholarship does that. Now if he thinks we should give children cash awards who do well and do not attend college then that should be a recommendation of its own.

As a small business owner I am very intrigued by all of Mr. Laffer’s ideas, but in a state as seriously in financial hell as we are, how do you start? I wold love to eliminate all these state, county and city taxes and remove the state income tax and go to a consumption tax like Florida, Tennessee and Texas. Also, coming from the southern part of the state, there are GENERATIONS of people who have never worked and live in abject poverty. You must make them do something to motivate them forward and simply not give them everything they need based on the dependents they produce.

The Lauffer Curve (or “Laughing Curve” when I studied economics in college) is a failure. Although it sounds good in theory, no state has survived the trough from the downturn in revenue and made it out the other side.